Industry News

HOUSTON, April 30 (Reuters) - Oil prices fell 1% on Tuesday, extending losses from Monday, on the back of rising U.S. crude production, as well as hopes of an Israel-Hamas ceasefire. Brent crude futures for June, which expired on Tuesday, settled down 54 cents, or 0.6%, at $87.86 a barrel. The more active July contract fell 87 cents to $86.33. U.S. West Texas Intermediate crude futures were down 70 cents, or 0.9%, at $81.93. The front-month contract for both benchmarks lost more than 1% on Monday. U.S. crude production rose to 13.15 million barrels per day (bpd) in February from 12.58 million bpd in January in its biggest monthly increase since October 2021, the Energy Information Administration said. Meanwhile, exports climbed to 4.66 million bpd from 4.05 million bpd in the same period. U.S. crude oil inventories rose by 4.91 million barrels in the week ended April 26, according to market sources citing American Petroleum Institute figures on Tuesday. Stocks were expected to have fallen by about 1.1 million barrels last week, an extended Reuters poll showed on Tuesday. Official data from the EIA is due on Wednesday morning. Gasoline inventories fell by 1.483 million barrels, and distillates fell by 2.187 million barrels. Expectations that a ceasefire agreement between Israel and Hamas could be in sight have grown in recent days following a renewed push led by Egypt to revive stalled negotiations between the two. However, Israeli Prime Minister Benjamin Netanyahu vowed on Tuesday to go ahead with a long-promised assault on the southern Gaza city of Rafah. "Traders believe some of the geopolitical risk is being taken out of the market," said Dennis Kissler, senior vice president of trading at BOK Financial. "We're not seeing any global supply being taken off the market." Continued attacks by Yemen's Houthis on maritime traffic south of the Suez Canal - an important trading route - have provided a floor for oil prices and could prompt higher risk premiums if the market expects crude supply disruptions. Investors also eyed a two-day monetary policy meeting by the Federal Reserve Open Market Committee (FOMC), which gathers on Tuesday. According to the CME's FedWatch Tool, it is a virtual certainty that the FOMC will leave rates unchanged at the conclusion of the meeting on Wednesday. "The upcoming Fed meeting also drives some near-term reservations," said Yeap Jun Rong, market strategist at IG, adding that a longer period of elevated interest rates could trigger a further rise in the dollar while also threatening the oil demand outlook. Some investors are cautiously pricing in a higher probability that the Fed could raise interest rates by a quarter of a percentage point this year and next as inflation and the labor market remain resilient. U.S. product supplies of crude oil and petroleum products, EIA's measure of consumption, rose 1.9% to 19.95 million bpd in Feb. However, concerns over demand have crept up as diesel prices weakened . Balancing the market, output from the Organization of the Petroleum Exporting Countries has fallen in April, a Reuters survey found, reflecting lower exports from Iran, Iraq, and Nigeria against a backdrop of ongoing voluntary supply cuts by some members agreed with the wider OPEC+ alliance. A Reuters poll found that oil prices could hold above $80 a barrel this year, with analysts revising forecasts higher on expectations that supply will lag demand in the face of Middle East conflict and output cuts by the OPEC+ producer group. View on the Reuters Website

Last year, the demand for loans from oil and gas companies fell 6% year-on-year, and that followed a decline of 1% in 2022. Oil and gas companies don’t need a lot of loans because they’re generating so much money these days from their underlying businesses, said Andrew John Stevenson, senior analyst at Bloomberg Intelligence. And that trend is likely to continue through the end of the decade, he said. “The oil and gas industry has experienced a number of booms and busts over the past few decades, but for now, it appears to be flush with cash,” he said. The healthy balance sheets reflect the boost that companies have received from rising oil prices, buoyed by robust demand and OPEC+ production cuts. The sector’s free cash flow is so strong that the group’s leverage ratio, which measures a company’s net debt relative to earnings before interest, taxes, depreciation and amortization, fell to 0.8 in 2023 from 2.4 in 2020, Stevenson said. The ratio will likely slide below zero by the end of the decade, he said.

Exxon Mobil (XOM.N), opens new tab will bring its Permian basin output up to 2 million barrels per day by 2027, while it also ramps up production in Guyana, Vice President of Global Exploration John Ardill said on Tuesday at a conference in Houston. Exxon has grown its position in the Permian significantly since 2017, when it acquired some 250,000 acres from the Bass family that held an estimated 3.4 billion barrels of oil equivalent. Last year, it said it would buy shale producer Pioneer Natural Resources, further growing its footprint in the Permian. The company is also planning to bring Guyana oil output to 1.2 billion barrels per day by 2027. View on the Reuters Website

U.S. oil production will grow to exceed 14 million barrels per day and then plateau, ConocoPhillips CEO Ryan Lance forecast on Tuesday. Output in the top U.S. shale field, the Permian basin of West Texas and New Mexico, will rise between 300,000 bpd and 400,000 bpd this year, he said in remarks at the CERAWeek energy conference. Construction of the company's $8 billion Alaskan oil development project, called Willow , is fully underway and will take four years to complete, he said. View on the Reuters Website

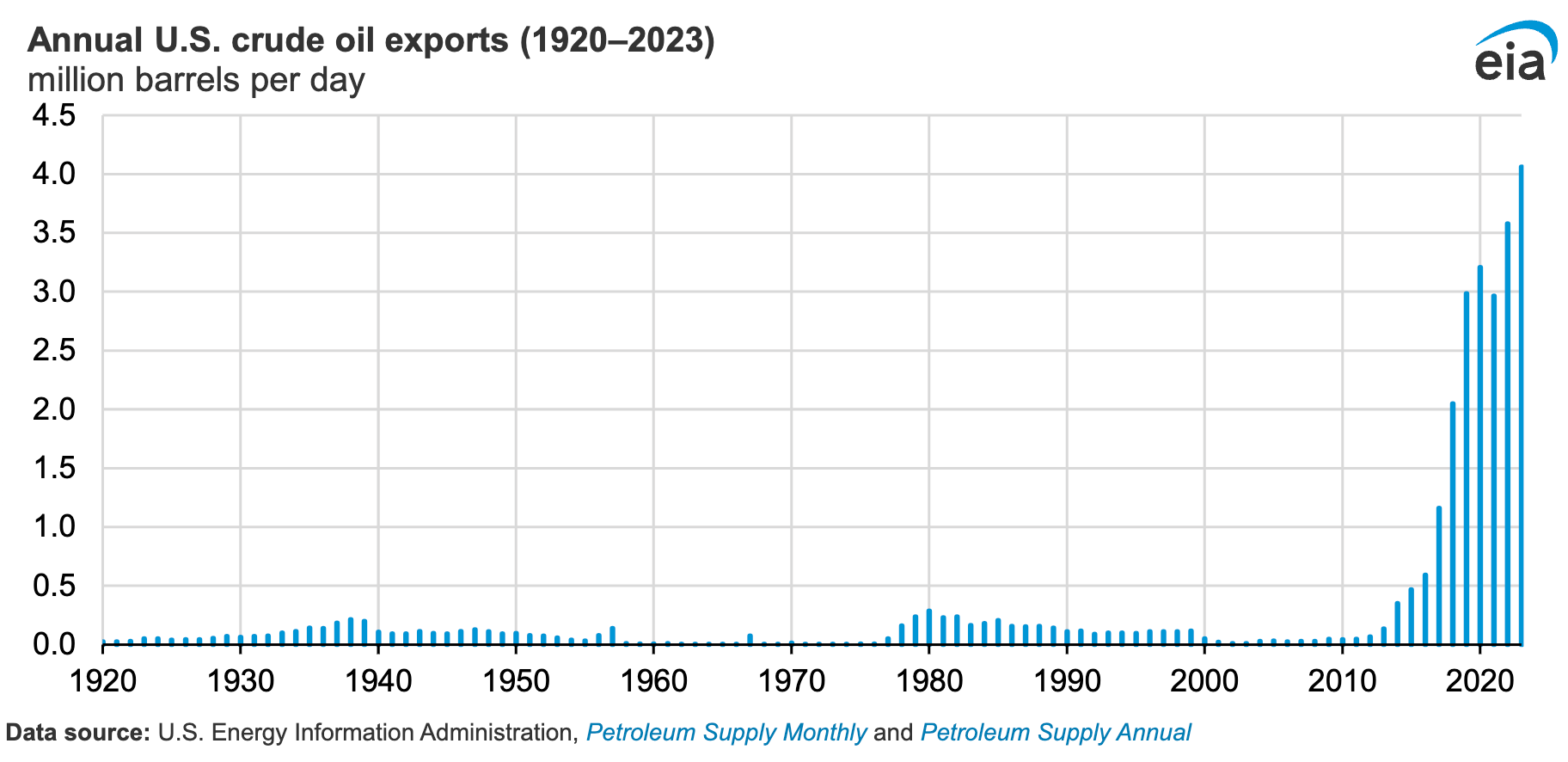

U.S. crude oil exports established a record in 2023, averaging 4.1 million barrels per day (b/d), 13% (482,000 b/d) more than the previous annual record set in 2022. Except for 2021, U.S. crude oil exports have increased every year since 2015, when the U.S. ban on most crude oil exports was lifted . Growth in crude oil production in the United States has supported increases in U.S. crude oil exports. In 2023, crude oil production reached a record-high 12.9 million b/d in the United States, a 9% (1.0 million b/d) increase from 2022. Many U.S. refineries are optimized to run heavy, sour crude oils , but most of the crude oil produced in the United States is light, sweet crude oil, creating export incentives for market participants. The top regional destinations for U.S. crude oil exports since 2018 have been Europe as well as Asia and Oceania. Europe became the top export destination in 2023 following the effects of Russia’s full-scale invasion of Ukraine and the inclusion of West Texas Intermediate (WTI) crude oil in Dated Brent. In 2022, U.S. crude oil exports to Europe increased significantly following Russia’s full-scale invasion of Ukraine and subsequent EU sanctions banning imports of seaborne crude oil from Russia (adopted June 3, effective December 5). These effects of the sanctions contributed to continued growth in U.S. exports to Europe in 2023. In 2023, U.S. crude oil exports to Europe averaged 1.8 million b/d, slightly more than U.S. exports to Asia and Oceania of 1.7 million b/d. Another factor affecting the volume of U.S. crude oil exports to Europe is the inclusion of WTI crude oil in Dated Brent, a European crude oil benchmark. Prior to May 2023, the price of Dated Brent was determined based on a basket of different European crude oils. Starting in May 2023 (for physical delivery in June), WTI cargoes delivered to Rotterdam were included, likely attracting additional volumes to Europe.

March 15 (Reuters) - U.S. energy firms this week added the biggest number of oil and natural gas rigs in a week since September, with the oil rig count also rising to its highest in six months, energy services firm Baker Hughes (BKR.O) said in its closely followed report on Friday. The oil and gas rig count, an early indicator of future output, rose by seven to 629 in the week to March 15. Despite this week's rig increase, Baker Hughes said the total count was still down 125 rigs or 16.6% below this time last year. Baker Hughes said oil rigs rose six to 510 this week, their highest since September, while gas rigs rose one to 116. The oil and gas rig count dropped about 20% in 2023 after rising by 33% in 2022 and 67% in 2021, due to a decline in oil and gas prices, higher labor and equipment costs from soaring inflation and as companies focused on paying down debt and boosting shareholder returns instead of raising output. U.S. oil futures were up over 13% so far in 2024 after dropping by 11% in 2023. U.S. gas futures , meanwhile, were down about 33.7% so far in 2024 after plunging by 44% in 2023. Despite lower prices, spending and rig counts, U.S. oil and gas output was still on track to hit record highs in 2024 and 2025 due to efficiency gains and as firms complete work on already drilled wells. Reporting by Scott DiSavino in New York and Anjana Anil in Bengaluru Editing by Marguerita Choy View on the Reuters Website

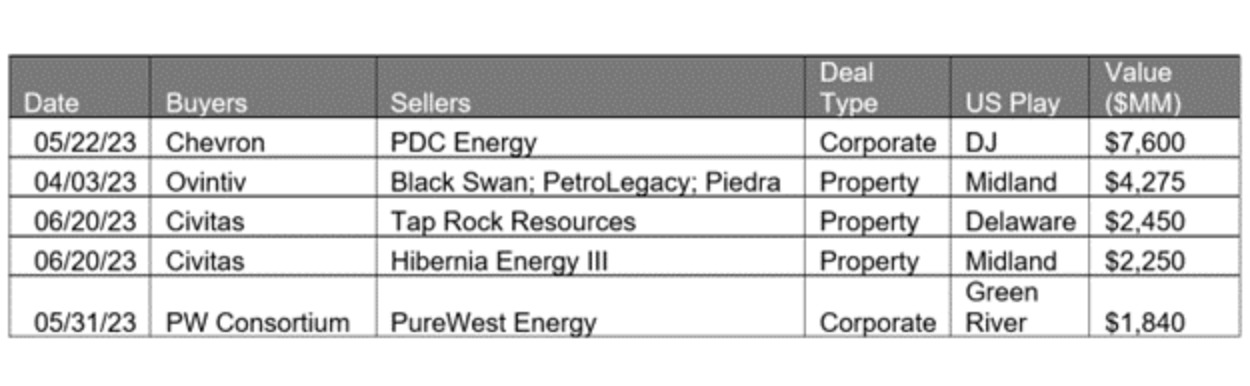

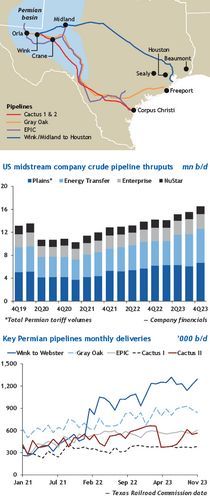

Crude pipeline volumes for the four biggest US midstream operators logged a record high of 16.5mn b/d in the fourth quarter, according to company data, mostly driven by rising flows from the Permian basin. Overall flows were up by 6pc from the previous quarter and up by more than 50pc from the 10.8mn b/d logged in the first quarter of 2021, which was the low-water mark for the COVID-19 pandemic cycle. Flows remained well above the baseline level of 14.3mn b/d set in the first quarter of 2020 before pandemic-induced demand shocks and a battle for market share between Saudi Arabia and Russia sent crude prices tumbling to historic lows. Permian basin pipeline operators' fates are closely tied to field producers in west Texas and eastern New Mexico, who saw an unprecedented drop in output in April 2020 along with a day of negative pricing at the US pipeline hub of Cushing, Oklahoma. The tides have since turned in the Permian, where rising output drove overall US crude production to an all-time record of 13.3mn b/d in December. ExxonMobil's $59.5bn takeover of US independent Pioneer Natural Resources doubles down on the prolific basin's staying power. US midstream operator Plains All American Pipeline said it expects output from the Permian to set a fresh record high in 2024, synchronizing with oil majors' plans to boost production in the top-performing shale basin. Permian output is expected to grow to 6.4mn b/d in 2024 from 6.1mn b/d in 2023, Plains said in an investor presentation. Place your bets The increase will be mainly driven by efficiency gains, as the number of active rigs in the basin holds at 300-320 horizontal rigs. "Our bet would be on the US [exploration and production companies], that they would figure out how to get higher recoveries" from the Permian basin, Plains executive vice-president Al Swanson said. Plains' projections are in line with recent guidance from top US oil majors, who are targeting longer lateral wells and faster drilling times to squeeze more output from existing infrastructure. Chevron aims to boost Permian output by 10pc this year, while ExxonMobil expects 7pc growth from its operations there. Long-haul volumes on Plains' crude pipelines rose by 17pc from the previous quarter to 1.6mn b/d and were up by 7pc from year-earlier levels. Plains said it expects high utilization on the 670,000 b/d Cactus II pipeline, its joint venture with Enbridge, which runs from the Permian to Corpus Christi, Texas, on the central coast. It also expects rising volumes on its Basin pipeline system from Midland, Texas, to the US midcontinent storage hub at Cushing. The lion's share of gains in output from the top four US midstream operators came from Plains and Energy Transfer, while Enterprise Products Partners' volumes held steady and NuStar volumes were up by 100,000 b/d to 1.3mn b/d. Energy Transfer set record volumes on its crude pipeline system in the fourth quarter as production from the Permian rose. Texas crude transport volumes rose by 39pc from a year earlier to 5.9mn b/d, driven by rising output from the Permian. Crude volumes also got a boost from Energy Transfer's recent acquisitions. Energy Transfer in August agreed to buy Crestwood Equity Partners in a transaction valued at $7.1bn, after moving to purchase Lotus Midstream in March for $1.45bn. The Lotus acquisition assets included the Centurion pipeline that connects Permian producers with the hub at Cushing, and more than 2mn bl of storage capacity in Midland. Volumes on Energy Transfer's Bakken pipeline were higher because of rising output from the Bakken shale in North Dakota, and volumes on its Bayou Bridge system in Louisiana grew because of strong Gulf Coast refinery demand. Energy Transfer's crude exports from its terminals in Nederland and Houston, Texas, fell to 3.4mn b/d, down by 5pc from the previous quarter's record of 3.6mn b/d but up by 16pc from a year earlier. Enterprise Products Partners posted record volumes on its crude pipelines and marine terminals in the fourth quarter. Crude pipeline transportation volumes increased to a record 2.6mn b/d in the fourth quarter, up marginally from the previous quarter and a 32pc increase from a year earlier, with increased flows on its Midland-to-Echo system from the Permian to the Houston area. Enterprise moved a record 1mn b/d at its crude oil marine terminals in the fourth quarter, up slightly from the previous quarter and up by 32pc from a year earlier, with rising volumes at the Enterprise Hydrocarbons Terminal (EHT) on the Houston Ship Channel. "We are seeing more crude across our docks," Enterprise co-chief executive Jim Teague said. By Chris Baltimore View on the Argus Website

DUBAI, March 3 (Reuters) - OPEC+ members led by Saudi Arabia and Russia agreed on Sunday to extend voluntary oil output cuts of 2.2 million barrels per day into the second quarter, giving extra support to the market amid concerns over global growth and rising output outside the group. Saudi Arabia, the de facto leader of the Organization of the Petroleum Exporting Countries (OPEC), said it would extend its voluntary cut of 1 million barrels per day (bpd) through the end of June, leaving its output at around 9 million bpd. Russia, which leads OPEC allies collectively known as OPEC+, will cut oil production and exports by an extra 471,000 bpd in the second quarter. Russian Deputy Prime Minister Alexander Novak gave new figures showing that cuts from production will make up a rising proportion of the measure. Oil has found support in 2024 from rising geopolitical tensions and Houthi attacks on Red Sea shipping, although concern about economic growth has weighed. While OPEC+ was widely expected to keep the cuts in place, Russia's announcement could bolster prices further. "There was a surprise from Russia," said UBS analyst Giovanni Staunovo, who called the developments largely expected. "If the Russian cuts are fully implemented additional barrels would be removed from the market. So that is a surprise move no one expected and could lift prices," he added. Brent crude settled $1.64 higher, or 2%, at $83.55 a barrel on Friday, up more than 8% so far this year. OPEC+ members announced the cuts individually on Sunday and OPEC later issued a statement confirming the 2.2 million bpd total. Saudi state news agency SPA said the cuts would be reversed gradually, according to market conditions. "The decision sends a message of cohesion and confirms that the group is not in a hurry to return supply volumes, supporting the view that when this finally happens, it will be gradual," analysts at investment bank Jefferies said in a report. OIL SEEN OPENING HIGHER OPEC+ in November had agreed to the voluntary cuts totaling about 2.2 million bpd for the first quarter, led by Saudi Arabia rolling over a cut it had first made in July. "The rollover was anticipated but extending it to the end of the second quarter might come as a surprise," said Tamas Varga of oil broker PVM. "The market is expected to open stronger." For the second quarter, Iraq will extend its 220,000 bpd output cut, UAE will keep in place its 163,000 bpd output cut, and Kuwait will maintain its 135,000 bpd output cut, the three OPEC producers said in separate statements. Algeria also said it would cut by 51,000 bpd and Oman by 42,000 bpd. Kazakhstan said it will extend its voluntary cuts of 82,000 bpd through the second quarter. OPEC+ has implemented a series of output cuts since late 2022 to support the market amid rising output from the United States and other non-member producers and worries over demand as major economies grapple with high-interest rates. The total OPEC+ pledged cuts since 2022 stand at about 5.86 million bpd, equal to about 5.7% of daily world demand, according to Reuters calculations. Sources told Reuters last week that OPEC+ would consider extending the latest round of output cuts into the second quarter, with one saying it was "likely". The oil demand outlook is uncertain for this year. OPEC expects another year of relatively strong demand growth of 2.25 million bpd, led by Asia, while the International Energy Agency expects much slower growth of 1.22 million bpd. In a further headwind for OPEC+, the IEA also expects oil supply to grow to a record high of about 103.8 million bpd this year, almost entirely driven by producers outside OPEC+, including the United States, Brazil, and Guyana. Reporting by Maha El Dahan in Dubai, Alex Lawler in London, Vladimir Soldatkin in Moscow and Ahmad Ghaddar; Writing by Yousef Saba; Editing by Jan Harvey, Nick Macfie and Alexander Smith View on the Reuters Website

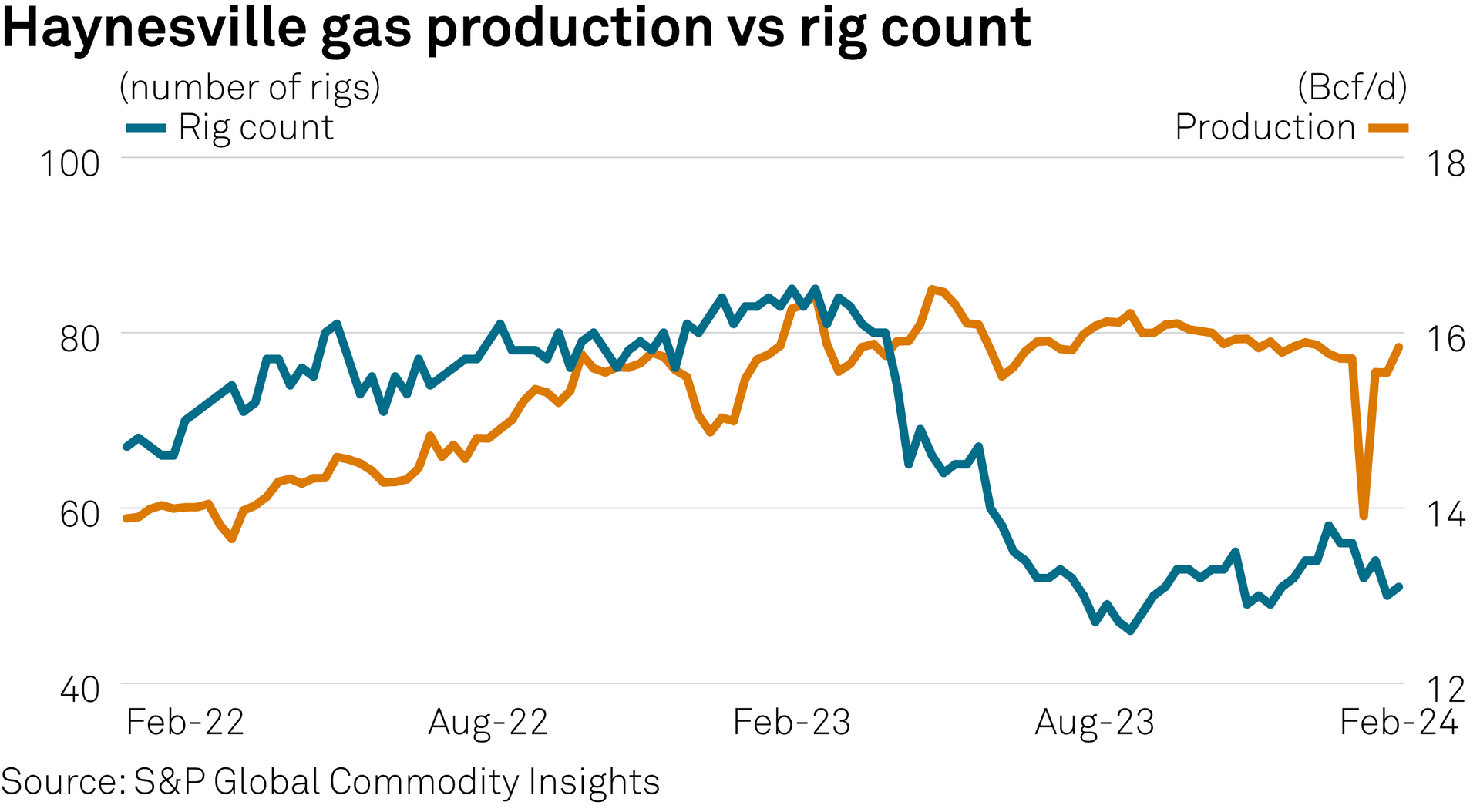

Sub-$2 gas prices at the US benchmark Henry Hub are putting operators in the Haynesville Shale under the gun recently, raising questions about the potential for a slowdown in drilling and production there. In 2024, NYMEX prompt-month gas futures have averaged just $2.35/MMBtu to trend at their lowest year-to-date price since 2020. Over the past four weeks, mild US temperatures, flagging gas demand and bearish weather forecasts have sent futures prices even lower. On the NYMEX, the prompt-month gas contract is down more than 45% from the upper-$2 area in late January, testing a new low recently at just over $1.50/MMBtu, data from S&P Global Commodity Insights showed. In the Haynesville Shale, many, if not most, producers are already feeling the price pain this year. Even for highly efficient operators with the highest-quality acreage, the Henry Hub breakeven price for Haynesville gas is currently estimated at $2.67/MMBtu. For producers looking to return 30% free cash flow -- a reasonable metric for Wall Street investors these days -- that wellhead clearing price rises to $3.21/MMBtu for class-1 and $3.57/MMBtu for class-2 acreage, S&P Global Commodity Insights estimate show.

U.S. President Joe Biden looks on as he meets with German Chancellor Olaf Scholz in the Oval Office at the White House in Washington, U.S., February 9, 2024. REUTERS/Evelyn Hockstein WASHINGTON, Feb 15 (Reuters) - A bill to strip the power of President Joe Biden's administration to freeze approvals of liquefied natural gas exports passed in the Republican-controlled U.S. House of Representatives on Thursday but faces an uphill battle in the Senate. The House approved the bill sponsored by Representative August Pfluger of gas-producing Texas 224-200 on a mostly party-line vote. The legislation needs to be passed in the Democratic-controlled Senate and signed by Biden to become law, both of which are unlikely. ClearView Energy Partners, a nonpartisan policy research group, called the bill more of a "messaging effort and a start to debate than an end to the pause," and said it was unlikely to clear the Senate. The bill strips the power to approve the exports from the Department of Energy and leaves the independent Federal Energy Regulatory Commission as the sole body approving LNG projects. Biden paused the approvals late last month for exports to big markets in Europe and Asia in order to take a "hard look" at environmental and economic impacts of the booming business. The United States became the largest LNG exporter last year, and its exports are expected to double by the end of the decade. Pfluger said U.S. LNG supports allies and partners, including those in Europe, which is weaning itself off gas from Russia after Russia's invasion of Ukraine in 2022. "The world needs U.S. LNG, this catastrophic, politically based, and legally dubious ban must be reversed immediately," he said. Representative Maxwell Frost, a 27-year-old Democrat, said climate advocates who fought LNG projects are heroes. "I can only hope and pray and fight to make sure that we build off" Biden's pause to "get to a green, clean future." The pause has met with outcry from Republicans who say it will hurt jobs and harm energy security for allies. Some moderate Democrats have also been skeptical of the pause, saying they will push to stop it if it hits jobs. European Commission Executive Vice President Maros Sefcovic said this week after meeting with Biden officials that the pause will have no impact on U.S. supplies to Europe over the next two or three years. Sefcovic said the U.S. is now the "global guarantor of energy security" and its responsibility goes beyond Europe. The White House said this week it strongly opposes the House bill but stopped short of a veto threat. Reporting by Timothy Gardner; Additional reporting by Richard Cowan; Editing by Frances Kerry and Jonathan Oatis View on the Reuters Website

(Bloomberg) -- Supply is back in the driver’s seat for global oil markets. At issue is rising crude production from non-OPEC+ nations including the US, which could outstrip global demand that’s still growing but at a slower pace. The oil cartel’s response has been to pledge deeper output cuts, but traders are skeptical they’ll be sufficiently implemented to fully eliminate a surplus. The combination has already pushed crude to its first annual decline since 2020 — both Brent and West Texas Intermediate fell over 10% last year — upending expectations of higher prices stemming from a post-pandemic recovery. Complicating the picture further, speculators have tightened their grip on the market, fueling price swings that are sometimes divorced from fundamentals. Looking ahead “further than a quarter seems very difficult to me” said Trevor Woods, chief investment officer of commodities fund Northern Trace Capital LLC. “This year coming up is a tricky, tricky year.” Oil is relying heavily on the Organization of the Petroleum Exporting Countries and allies for support, and a collapse in the group’s earlier agreement to curb supply could send prices crashing, he said. There’s weakness coming through in multiple indicators. The Brent futures curve stood in a bearish contango structure for most of December, with contracts for near-term barrels trading at discounts to later ones. And speculators in 2023 were the most bearish they’ve been on the commodity in more than a decade. Net-long positions held by non-commercial players across the major oil contracts on average stand at the lowest in records dating back to 2011, according to data compiled by Bloomberg. “The market may have finally moved into ‘show-me mode,’ which will require some combination of substantial stock draws, stronger grades, structure and margins before buying interest returns,” said Vikas Dwivedi, Macquarie Group Ltd.’s global energy strategist. At least twice in 2023, money managers piled into short positions ahead of OPEC+ meetings and responded to the group’s production cut announcements with waves of selling. Their diminishing faith in the cartel’s ability to balance the market has been further compounded by the rise of algorithmic trading, which can now account for nearly 80% of the daily trades in oil and increasingly fuels prices swings that are independent of fundamentals. A wave of consolidation among producers is also weakening the futures market’s link to physical flows. Speculators will need some convincing before deciding to turn decisively long on oil in 2024. Commodity hedge funds saw returns slump last year to the lowest since 2019, while raw-material prices logged their first decline in five years, according to Bloomberg indexes. Notably, oil trader Pierre Andurand’s eponymous hedge fund was headed for its worst loss on record. OPEC Versus Shale OPEC+’s additional 900,000 barrels a day of voluntary supply curbs, agreed to just a few weeks ago, are a sticking point for analysts and traders trying to price in global demand and supply balances. Traders wonder if the group will deliver enough of the cutbacks to rein in the looming surplus. The cartel faces a “balancing act,” said Parsley Ong, head of Asia energy and chemicals research at JPMorgan Chase & Co. It “revolves around the fact that US producers are fundamentally price sensitive. The higher OPEC+ keeps oil prices by reducing production, the more traditional oil producers and US shale production will respond to that and boost supply.” In the US, weekly crude production hit a record 13.3 million barrels a day last month, as drillers from the Permian Basin in West Texas to the Bakken Shale of North Dakota ramped up oil production well beyond what analysts foresaw. And in 2024, output is expected to set a new all-time high, according to the US Energy Information Administration. Brazil and Guyana are also set to boost supplies significantly, contributing to a wave of new crude from the Americas. Demand Growth On the demand side, global consumption growth should slow as economic activity weakens, according to the International Energy Agency’s latest market outlook. The group forecasts demand will edge up by 1.1 million barrels a day this year. While that’s less than half of 2023’s latest estimated growth rate, the figure is still high by historical standards. Consumption is normalizing after the once-in-a-generation disruption caused by the pandemic and in the US, growing expectations of a so-called soft landing are buoying energy demand. Still, the global picture is uneven with a rapid switch away from oil in some sectors. In China, Asia’s top crude importer, the electrification of cars is presenting structural headwinds for oil consumption, weighing on demand growth, said Anthony Yuen, head of energy strategy at Citigroup Inc. “This is limiting oil’s sensitivity toward wider macroeconomic factors,” he said. “In the past, economic indicators might directly translate into higher ground transportation and fuel demand,” but this relationship now appears to be weakening as electric vehicle uptake increases. Analysts are, however, mindful of geopolitical risks. Attacks in the Red Sea by Yemen-based Houthi militants remain in focus, and Russia is still waging war in Ukraine. The year’s opening week has already seen such risks come to the fore, with multiple attacks in the Red Sea by the Houthis and two of Libya’s oil fields, which normally pump about 365,000 barrels a day combined, shut by protesters. That’s adding to short-term price fluctuations and more uncertainty. But ultimately, global producers still have the power to withhold output to meet demand trends, although that will boil down to discipline and intention. “OPEC+ is interested in maximizing their revenue, so it’s in their interest to consider producing more,” said Citi’s Yuen. “But I think it will depend on how production from non-OPEC sources pans out over next year.” --With assistance from Grant Smith. (Adds oil price move in 3rd paragraph, latest Middle Eastern developments in 17th paragraph) View on the BNN Bloomberg website

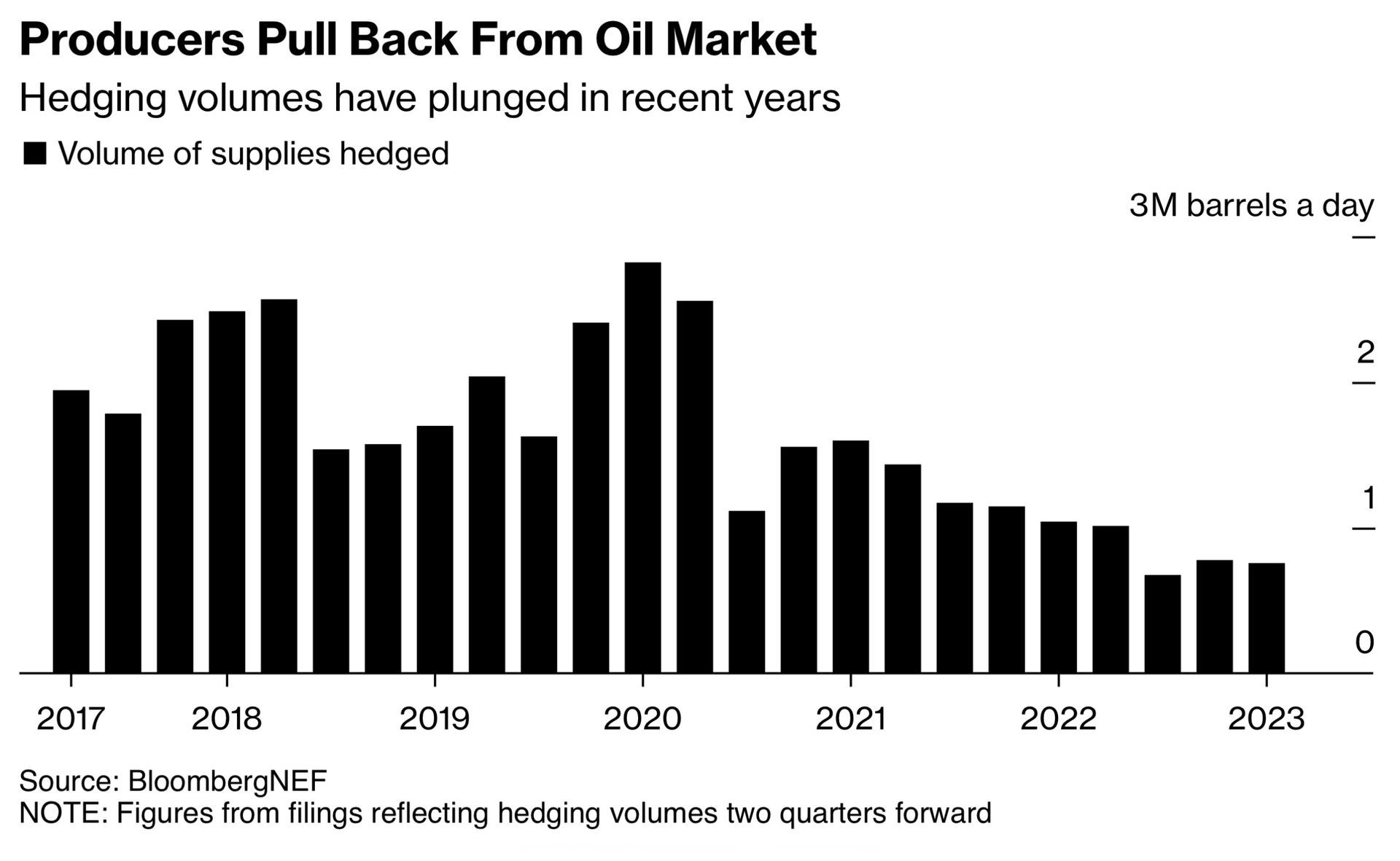

Supermajors' refining, retail arms cut need to use derivatives Producers have reduced market activity in recent years Hess Corp. and Pioneer Natural Resources Co. have in recent years bought large derivatives positions to lock in prices for their future production. Those holdings are set to dry up after the drillers' takeovers by Chevron Corp. and Exxon Mobil Corp. because super majors tend to not hedge, instead using their refining and retail operations as natural buffers against price moves. Two other top hedgers - Devon Energy Corp. and Marathon Oil Corp. - are also said to have held merger talks. The consolidation threatens to accelerate a decline in listed producers' activity in the oil derivatives market, potentially increasing volatility and exposing drillers to steeper earnings drops in the event of a price crash. US oil producers had about 750,000 barrels a day of supplies locked in using derivatives contracts in the first quarter, down more than two thirds since before the pandemic, according to data from BloombergNEF. Those are near the lowest levels in data dating back to 2017.

NEW YORK, Oct 31 (Reuters) - U.S. field production of crude oil rose to a new monthly record in August at 13.05 million barrels per day, the Energy Information Administration said on Tuesday. Output rose 0.7% in August from the month prior, the data showed. The previous monthly high was in November 2019, when production reached 13.0 million bpd. The monthly high is still shy of a weekly record for U.S. oil production at 13.2 million bpd, hit in the week to Oct. 6. Production in the world's top oil producer recovered slowly over the last three years as companies used record profits to increase dividends and buybacks rather than spending to rapidly increase drilling and production. In Texas, the top U.S. oil-producing state, output in August rose by 0.5% to a monthly record of 5.63 million bpd, the EIA data showed. In New Mexico and North Dakota, production rose to nearly 1.80 million bpd and 1.22 million bpd, respectively. Gross natural gas production in the U.S. Lower 48 states rose 1.2 billion cubic feet per day (bcfd) to a record 116.3 bcfd in August from 115.0 bcfd in July, according to EIA's monthly 914 production report. That topped the prior all-time high of 115.2 bcfd in May. In top gas-producing states, monthly output in August rose 0.9% in Texas to a new record 34.4 bcfd and 0.5% % in Pennsylvania to 20.9 bcfd. That topped the prior all-time high of 34.1 bcfd in Texas in July and compares with a record 21.9 bcfd in Pennsylvania in December 2021. In demand, U.S. product supplied of crude and petroleum products rose in August to 20.88 million bpd, the highest since August 2019, EIA data showed. Demand for motor gasoline gained to nearly 9.3 million bpd, the highest since June 2021. Reporting by Stephanie Kelly, Shariq Khan and Scott DiSavino; Editing by David Gregorio and Jonathan Oatis View on the Reuters website

WASHINGTON, Oct 31 (Reuters) - The World Bank said on Monday it expected global oil prices to average $90 a barrel in the fourth quarter and fall to an average of $81 in 2024 as slowing growth eases demand, but warned that an escalation of the latest Middle East conflict could spike prices significantly higher. The World Bank's latest Commodity Markets Outlook report noted that oil prices have risen only about 6% since the start of the Israel-Hamas war, while prices of agricultural commodities, most metals and other commodities "have barely budged." The report outlines three risk scenarios based on historical episodes involving regional conflicts since the 1970s, with increasing severity and consequences. A "small disruption" scenario equivalent to the reduction in oil output seen during the Libyan civil war in 2011 of about 500,000 to 2 million barrels per day (bpd) would drive oil prices up to a range of $93 to $102 a barrel in the fourth quarter, the bank said. A "medium disruption" scenario - roughly equivalent to the Iraq war in 2003 - would cut global oil supplies by 3 million to 5 million bpd, pushing prices to between $109 and $121 per barrel. The World Bank's "large disruption" scenario approximates the impact of the 1973 Arab oil embargo, shrinking the global oil supply by 6 million to 8 million bpd. This would initially drive up prices to $140 to $157 a barrel, a jump of up to 75%. "Higher oil prices, if sustained, inevitably mean higher food prices," said Ayhan Kose, the World Bank’s Deputy Chief Economist. "If a severe oil-price shock materializes, it would push up food price inflation that has already been elevated in many developing countries." The World Bank report said that China's oil demand was surprisingly resilient given strains in the country's real estate sector, rising 12% in the first nine months of 2023 over the same period of 2022. Oil production and exports from Russia have been relatively stable this year despite Western-imposed embargoes on Russian crude to punish Moscow over its invasion of Ukraine, the World Bank said. RUSSIAN PRICE CAP 'UNENFORCEABLE' Russia's exports to the European Union, the U.S., Britain and other Western countries fell by 53 percentage points between 2021 and 2023, but these have been largely replaced with increased exports to China, India and Turkey - up 40 percentage points over the same period. "The price cap on Russian crude oil introduced in late 2022 appears increasingly unenforceable given the recent spike in Urals prices," the World Bank said, referring to the benchmark Russian crude, currently quoted in the mid-$70s per barrel range, well above the G7-led $60 price cap for Russian crude. The cap aims to deny buyers of Russian crude the use of Western-supplied services, including shipping and insurance, unless cargoes are sold at or below the capped price. "It seems that by putting together a "shadow fleet" (of tankers), Russia has been able to trade outside of the cap; the official Urals benchmark recently breached the cap for more than three months, averaging $80 per barrel in August," the report said. If the Israel-Hamas conflict escalates, policymakers in developing countries will need to take steps to manage a potential increase in headline inflation, the World Bank said. It added that governments should avoid trade restrictions such as export bans on food and fertilizer because they can often intensify price volatility and heighten food insecurity. Reporting by David Lawder; Editing by Christian Schmollinger and Louise Heavens View on the Reuters website

Household Expenditures on Heating Oil Expected to Rise, but Expenditures on Propane Expected to Fall

In the 2023 Winter Fuels Outlook (WFO) supplement to our October Short-Term Energy Outlook (STEO), we forecast that U.S. households that heat primarily with heating oil will spend more this winter on heating, but households heating primarily with propane will spend less. Higher heating oil expenditures are driven by more consumption than last winter, and lower propane expenditures are driven by lower prices. However, there are significant regional variations in forecast propane expenditures, with expenditures in the Midwest lower than last winter, expenditures in the Northeast essentially flat, and expenditures in the South higher. We base our weather assumptions in the WFO, which also examines trends for households heating with natural gas and electricity, on data from the National Oceanic and Atmospheric Administration (NOAA) and the previous 30-year trend. We use heating degree days (HDDs) as a measure of how cold temperatures are compared with a base temperature—more HDDs indicate colder temperatures. Our warmer case has 10% fewer HDDs than our base assumption, and our colder case has 10% more. Beginning with this year’s WFO, we consider winter to run from November through March. In previous years, winter also included October. We recalculated the previous winters referenced in this report to exclude October data. In our base case, we forecast that the 4% of U.S. households that heat primarily with heating oil will spend an average of $1,851 this winter, up 8% from last winter, and the 5% of U.S. households heating primarily with propane will spend $1,343, down 3% from last winter. In our 10% warmer-weather case, we forecast heating oil costs will average $1,648, and in our 10% colder-weather case, we forecast costs will average $1,969 (Figure 1). In our 10% warmer-weather case, we forecast propane costs will average $1,205, and in our 10% colder-weather case, we forecast costs will average $1,847.

Companies vie to impress a skeptical Wall Street by eking out growth Elite runners long chased the 4-minute mile. Major league sluggers competed for decades to beat Babe Ruth’s 60 home runs. For Dennis Degner, the next milestone is 25,000 feet. Oil and gas wells stretched just a fraction of that length laterally underground in 2010, when the now-chief executive of Range Resources joined the natural gas producer. Back then, innovations in horizontal drilling and fracking were just beginning to transform global energy markets. Now, with the end of the shale boom in sight, Wall Street is pressuring companies to cut spending and pony up returns to boost their share prices. Growth at all costs is out. The slow grind of achieving efficiency—alongside the office downgrades and recruiting struggles that come with it—is in.

More long money is entering the multi-million-acre Powder River Basin, proving early entrants’ potential from the stacked pay. A nearly $1 billion midstream deal in early September is long on new production potential of Wyoming’s Powder River Basin. Western Midstream Partners LP is buying 1,500 miles of gas-gathering pipe, 380 MMcf/d of processing capacity and the 120-mile, 38,000 bbl/d Thunder Creek NGL pipeline from Riverstone-backed Meritage Midstream Services II LLC for $885 million, cash. The infrastructure is in the Converse, Campbell and Johnson counties area of the basin’s leading producers: Devon Energy Corp. , Continental Resources Inc. , Occidental Petroleum Corp. , Anschutz Exploration and EOG Resources Inc. Western’s looking for the 1.4-million-dedicated-acre bolt-on to draw other operators into the system. Enverus reported after the news, “While Meritage’s counterparties were not named, they probably include Devon Energy, which had built much of the system to support its [Powder] operations.” The basin’s rig count was 15 in late August, similar to its year-end 2019 exit rate and its post-Covid recovery last year. Clay Gaspar, Devon’s COO, told securities analysts in August that appraisal continues in its 300,000 net acres. Three-mile-lateral tests have been working. Also, “since we are not observing any degradation in the results from three-well spacing, we plan to test four wells per section [in this half],” he said. Devon’s northern Powder holding “could extend the Niobrara potential into Campbell County.” Overall, findings have been “evident that our [acreage position] is providing Devon important resource catalysts for the future,” Gaspar said. In its Converse County leasehold, Devon has been drilling the Teapot formation in addition to Turner, Parkman and Niobrara. Its 2022 Powder production averaged 19,000 boe/d, about 84% oil and NGL. The Occidental Petroleum holding in the Powder came with its acquisition of Anadarko Petroleum Corp . Vicki Hollub, Oxy president and CEO, told analysts in August that Permian Basin learnings are being transferred to the Powder. In the southern fairway, “we're seeing good results there. And our appraisal team is beginning to work in the northern part,” she said. Anschutz, which was early in new, unconventional Powder exploration , has five rigs drilling in its nearly 500,000 net contiguous acres, producing more than 25,000 boe/d. Joe DeDominic, CEO, said at Hart Energy’s SUPER DUG conference in May it’s moving to full development mode now. “We see a decade-plus of drilling depending on [our rig] activity level. ...So we have a lot of inventory. We're very pleased with that.” Anschutz plans to expand to 2.5-mile laterals in one of its blocks in Campbell County “and then we can expand that as we move north,” he told Hart Energy. New entrants would need to be well-banked, he added. “You [have to] spend enough money to actually grow or you’re kind of not doing much at all. You're maybe staying flat at best.” Property is changing hands. Investment firm Pan Management ’s OneRock Energy Holdings LLC bought Apollo Global Management-backed Northwoods Management Co.’s 160,000 mostly contiguous net acres in Converse, Campbell and Johnson counties this summer that’s producing some 5,000 boe/d. Northwoods had picked up 112,000 of its acres, which were producing some 2,000 boe/d at the time, in January 2018 from SM Energy Co. for $500 million. Meanwhile, newly private Continental has been adding to its Powder. Harold Hamm, chairman, told Hart Energy this summer the Powder’s “needed somebody that had enough size and scale to consolidate the basin. And we’ve done a pretty good job of that, putting a huge leasehold together—and big enough that we could add scale to it.” There is a bounty of formations for tapping. “It’s a stacked pay. I mean, it’s just pay after pay after pay.”

Get ready for a Gulf Coast gas boom. Answering the call isn’t going to be the Marcellus, which is constrained, said Chesapeake Energy Corp. CEO Nick Dell’Osso. Nick Dell’Osso broke it down: Beginning next year, there will be 10 Bcf/d of greater demand for U.S. natural gas. The answer’s going to come first from the Haynesville Shale, secondly from the Permian Basin and then elsewhere — but not much from the Marcellus Shale, Chesapeake Energy Corp. ’s president and CEO told Barclays CEO Energy-Power conference attendees on Sept. 6. One of the world’s largest gas fields, the Marcellus is averaging some 35 Bcf/d currently and could produce more than 60 Bcf/d, according to industry estimates. But “the Marcellus is a constrained basin,” Dell’Osso told Barclays managing director and E&P analyst Betty Jiang. Meanwhile, 5.5 Bcf/d of additional LNG-export demand will come online on the U.S. Gulf Coast next year: Calcasieu Pass II and New Fortress. In 2025, an additional 8.5 Bcf/d call will begin at Golden Pass and Plaquemines 1.

Expro has announced it has entered into a definitive agreement (subject to customary closing conditions and working capital adjustments) to acquire offshore services provider, PRT Offshore. Total consideration to be paid at closing is approximately US$106 million, including US$62 million of cash and US$44 million of newly issued Expro shares. Potential additional consideration will be based on PRT Offshore’s financial performance during the four quarters following closing. Excluding possible cost and revenue synergies, total consideration is expected to be approximately 4.0x PRT Offshore’s estimated 2023 and 2024 adjusted EBITDA. Upon closing of the transaction, which is expected to be in the 4Q23, the acquisition will enable Expro to expand its portfolio of cost-effective, technology-enabled services and solutions within the subsea well access sector in the North and Latin America (NLA) region and accelerate the growth of PRT Offshore’s surface equipment offering in the Europe and Sub-Saharan Africa (ESSA) and Asia Pacific (APAC) regions. PRT Offshore is based in Houston, Texas, US, and provides a complete Hook-to-Hanger solution enabling comprehensive well completions, interventions and decommissioning services from surface to subsea. Its system is designed to allow customers to access the wellbore safely and efficiently, all while reducing personnel on board. Michael Jardon, Expro Chief Executive Officer, said: “Expro is committed to investing in innovation and technology to differentiate our services and solutions offering. This strategic acquisition is exciting for both Expro and PRT Offshore as we strengthen and expand our subsea well access technology offering and continue to deliver value to our customers across the life of their wells. “Our subsea well access portfolio has a strong and established international presence, particularly across ESSA and APAC. We believe this will provide significant opportunities to expand PRT Offshore’s presence in these attractive regions. Similarly, Expro will leverage PRT Offshore’s strong position in deep-water offshore well completion and intervention throughout the NLA region to deliver integrated customer solutions. “Building on Expro’s 40-year track record in subsea, we feel confident PRT’s offering and expertise will complement our existing technology and result in improved services, enhanced solutions, and an even more robust geographic presence. We look forward to welcoming PRT Offshore team to the Expro family.” View on the Oilfield Technology website

Pumping units at work outside Midland in this 2022 file photo. Oil and gas companies are increasingly integrating their production and finance data into one data stream to help make activity decisions and manage their assets. Joe Raedle/Photographer: Joe Raedle/Getty I In the infancy of the oil and gas industry, oilmen used gut instinct and intuition to drill wells. Technology today is developing data that serves as that gut instinct, that tuition. “Today we’re able to have data-driven decision making. It’s not so much a gut feeling of ‘I have a good feeling about this play but I’m looking at the data and it’s telling me this is a good place to drill, this is not a good place to drill.’ It backs up that intuition that’s been key to the industry, I feel, going back to the early days,” said Harrison Bedford, solutions engineering manager at W Energy Software. Participating in a webinar presented by Hart Energy, Bedford and Michael Tanner, director of FP&A at King Operating, discussed the growing trend of merging production and financial data to offer a more comprehensive picture of an operator’s assets, what is generating revenue and where funds are being sent. “Collaboration and communication are important because you’re able to increase the efficiency in which different departments can talk to each other, look at the data sets with all their contributing elements and you’re able to have good conversations about the operation of the business. It enables a more holistic and informed approach to spending capital, addressing reservoir management and allocating resources.” Tanner said integrating production and financial data initially saved his company 10 to 15 hours a week that were spent generating reports and cut down the costs of cleaning and aggregating the data as well as making sure it was accurate. In integrating production and financial data – what Tanner called the meat of what managers look at in making decisions on the next well to drill, acquisition strategies and the company’s future direction – be strategic in how the company wants the data pipeline to work, he advised. He said his company made sure the data ran parallel rather than in a series and that information was updated across the board. Also, make sure the software matches with the company’s standard operating procedure. And make sure the company’s staff knows they all have the same goal and work toward a single set of requirements. “Define the roadblocks specific to your company. Second, define a plan on how you’re going to integrate that data and, finally, get buy in from stakeholders across the organization. You really need everyone working together because ultimately the common goal is making the company more profitable and improving operations,” Bedford said. The oil and gas industry is undergoing a digital transformation that is probably in the earlier stages than believed, Bedford said. He predicted data-driven decisions will become the new norm, helping companies reduce risks and opening new opportunities. Tanner urged companies to embrace open source data and said, "the little guy has the advantage." Data integration is now standard and he predicted the "death of the dashboard." Written by Mella McEwen View on the Midland Reporter-Telegram website

Across oil-consuming economies, stress lines in oil consumption are continuing to form amid tight product supplies and high pump prices. That’s according to a new market note from energy and environmental geo-analytics company Kayrros, which highlighted that U.S. diesel demand and U.S. gasoline demand had slipped. “U.S. diesel demand, which had strongly benefited from online shopping during Covid and had long seemed impervious to rising prices, last week slipped below year-ago levels, in line with recent reports of sagging growth in online orders from major retailers,” Kayrros stated in the note, which was sent to Rigzone over the weekend. “U.S. gasoline demand shows even clearer signs of losing steam. U.S. passenger road transportation has been exceptionally strong until late May but has remained consistently below last year’s level since around Memorial Day weekend, traditionally seen as the kickoff of the peak driving season,” Kayrros added. According to a graph outlining on-road diesel consumption in the U.S., which was included in the note and which included data stretching back to 2019, the last time diesel demand slipped below last year’s levels was around the end of April. According to a graph outlining on-road gasoline consumption in the U.S., which was also included in the note and which also included data stretching back to 2019, prior to the latest stretch of year on year declines, the last time gasoline demand slipped below last year’s levels was also in April. In the note, Kayrros conceded that the recent slowdown in U.S. end-user gasoline demand growth occurs from a “high baseline” and against the backdrop of U.S. gasoline inventories “reported at seven-year lows”. Kayrros also stated in the note that its measurements of end-user gasoline demand had been consistently higher than U.S. official estimates of gasoline deliveries into secondary storage and said tight gasoline inventories appear consistent with Kayrros estimates. In a separate market note sent to Rigzone earlier this month, Kayrros outlined that the U.S. summer driving season was off to a slow start. The average price of regular gasoline in the U.S. was $4.655 per gallon on July 12, according to the AAA gas prices website. Yesterday’s average was $4.678 per gallon, the week ago average was $4.800 per gallon, the month ago average was $5.010 per gallon and the year ago average was $3.147 per gallon, the AAA site showed. The highest recorded average price for regular gasoline was seen on June 14 at $5.016 per gallon, according to the site. Average diesel prices in the U.S., as of July 12, came in at $5.625 per gallon, the AAA site showed. Yesterday’s average was $5.642 per gallon, the week ago average was $5.726 per gallon, the month ago average was $5.771 per gallon and the year ago average was $3.265 per gallon, according to the AAA site, which outlined that the highest recorded average price of diesel was seen on June 19 at $5.816 per gallon. View on the Rigzone website

(Bloomberg) -- Global oil demand has surged to a record amid robust consumption in China and elsewhere, threatening to push prices higher, the International Energy Agency said. World fuel use averaged 103 million barrels a day for the first time in June and may soar even higher in August, the agency said in a report. As Saudi Arabia and its partners constrict supplies, oil markets are tightening significantly. “Oil demand is scaling record highs, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity,” the Paris-based IEA said. “Crude and products inventories have drawn sharply” and “balances are set to tighten further into the autumn.” Oil this week touched a six-month high above $88 a barrel in London amid the post-pandemic resurgence in fuel use and supply restraint by the Saudi-led OPEC+ alliance. Brent futures eased back a little to trade below $87 on Friday. The plunge in world oil demand during the Covid-19 crisis three years ago spurred speculation that consumption may be close to a peak as remote working gained in popularity and governments sought to shift away from fossil fuels to avert catastrophic climate change. But the IEA data shows that, despite growing evidence of a warming planet shown by this summer’s heat waves and wildfires in the Northern Hemisphere, oil use is stronger than ever. China will account for 70% of this year’s demand growth, but surprisingly resilient developed nations added to the latest surge. Energy Shift The energy transition looks set to have an impact next year, when global demand growth will roughly halve to 1 million barrels a day due to improved vehicle efficiency and the adoption of electric cars, the IEA said. But in the meantime, world markets are tightening, leaving oil inventories in developed nations about 115 million barrels below their five-year average, according to the report. Global stockpiles are set to deplete by a hefty 1.7 million barrels a day in the second half of the year, and preliminary data appears to confirm declines in July and August, the IEA said. Major consuming nations have criticized the Saudis and their allies in OPEC+ for constricting supplies, warning that a renewed inflationary spike would squeeze consumers and endanger the global recovery. Nonetheless, Riyadh has said it could deepen current cutbacks if necessary. Output from the Organization of Petroleum Exporting Countries and its partners plunged last month to near a two-year low as the Saudis implemented a unilateral cut of 1 million barrels a day. Russia, a fellow member of the coalition, is also reducing exports. The need for OPEC’s crude during the fourth quarter looks a little less pressing compared with last month’s report, as a slightly weaker demand outlook for the period and a little extra supply elsewhere shave the requirement for OPEC production by 400,000 barrels a day. Nonetheless, an average of 29.8 million barrels a day is needed from the cartel’s 13 members between October and December — far more than the 27.9 million a day they pumped in July, according to the IEA. “If the bloc’s current targets are maintained, oil inventories could draw” significantly, the agency warned, “with a risk of driving prices still higher.” ©2023 Bloomberg L.P. View on the Bloomberg website

HOUSTON, Aug 2 (Reuters) - U.S. oil and gas company Chesapeake Energy (CHK.O) on Wednesday said it expects deflation in oilfield service costs by 5% to 7% next year as weaker drilling and completions activity hurts demand, even as service providers have vowed to maintain prices. U.S. shale producers have cut spending on drilling and completing new wells in response to weak oil and gas prices, reducing demand for equipment and services provided by oilfield service companies. Shares of Chesapeake Energy were down 2.7% at $82.14 in midday trading on Wednesday, one day after the company posted a 68% fall in second-quarter profit due to lower gas prices and production. Chesapeake Energy, among the top U.S. natural gas producers, said it expects costs to be 5% to 7% lower for a well it drills in the first quarter of next year compared with a well drilled in the first quarter of 2023 as prices for sand, pressure pumping and rigs are expected to soften. Shale producer Diamondback Energy (FANG.O) also said this week that it expects prices for oilfield equipment and services to fall in response to lower drilling activity. However, many drilling and frac service providers have said they expect to hold the line on pricing, adding that oilfield activity could recover later this year thanks to a recent uptick in oil and gas prices. On an adjusted basis, Chesapeake Energy earned 64 cents per share, beating analysts' average estimate of 42 cents, according to Refinitiv data. Reporting by Arathy Somasekhar in Houston; Editing by Susan Heavey View the full post on the Reuters website

Summary Price action in energy markets over the past month has been interesting. European natural gas has seen increased volatility, suggesting that the market is still nervous about supply risks, whilst the oil market is stuck in a range despite deeper Saudi supply cuts. A more hawkish Federal Reserve, limited speculative appetite (given the uncertain outlook), robust Russian supply and rising Iranian supply all suggest that the market will not trade as high as initially expected.

July 7 (Reuters) - U.S. energy firms this week added oil and natural gas rigs for the first time in 10 weeks, due to the biggest weekly increase in gas rigs since October 2016, energy services firm Baker Hughes Co said in its closely followed report on Friday. The oil and gas rig count, an early indicator of future output, rose six to 680 in the week to July 7. RIG-USA-BHIRIG-OL-USA-BHIRIG-GS-USA-BHI Despite this week's rig increase, Baker Hughes said the total count was still down 72 rigs, or 10%, below this time last year. U.S. oil rigs fell five to 540 this week, their lowest since April 2022, while gas rigs rose 11 to 135 their highest since early June. Data provider Enverus, which publishes its own rig count data, said drillers cut four rigs in the week to July 5, reducing the overall count to 732. That put the total count down about 10 rigs in the last month and down 13% year-over-year. U.S. oil futures were down about 9% so far this year after gaining about 7% in 2022. U.S. gas futures, meanwhile, have plunged about 43% so far this year after rising about 20% last year. The weekly gas rig count hike was unusual as the massive drop in gas prices has already caused some companies to reduce production by cutting rigs - especially in the Haynesville shale in Arkansas, Louisiana and Texas. Despite some plans to lower rig counts, the independent exploration and production companies tracked by U.S. financial services firm TD Cowen were on track to boost spending by about 19% in 2023 versus 2022 after increasing spending about 40% in 2022 and 4% in 2021. That increased spending will help keep U.S. crude production on track to rise from 11.9 million barrels per day (bpd) in 2022 to 12.6 million bpd in 2023 and 12.8 million bpd in 2024, according to projections from the U.S. Energy Information Administration (EIA) in June. That compares with a record 12.3 million bpd in 2019. U.S. gas production, meanwhile, was on track to rise from a record 98.13 billion cubic feet per day (bcfd) in 2022 to 102.74 bcfd in 2023 and 103.04 bcfd in 2024, according to EIA’s projection. Reporting by Scott DiSavino Editing by Marguerita Choy View the full post on their website

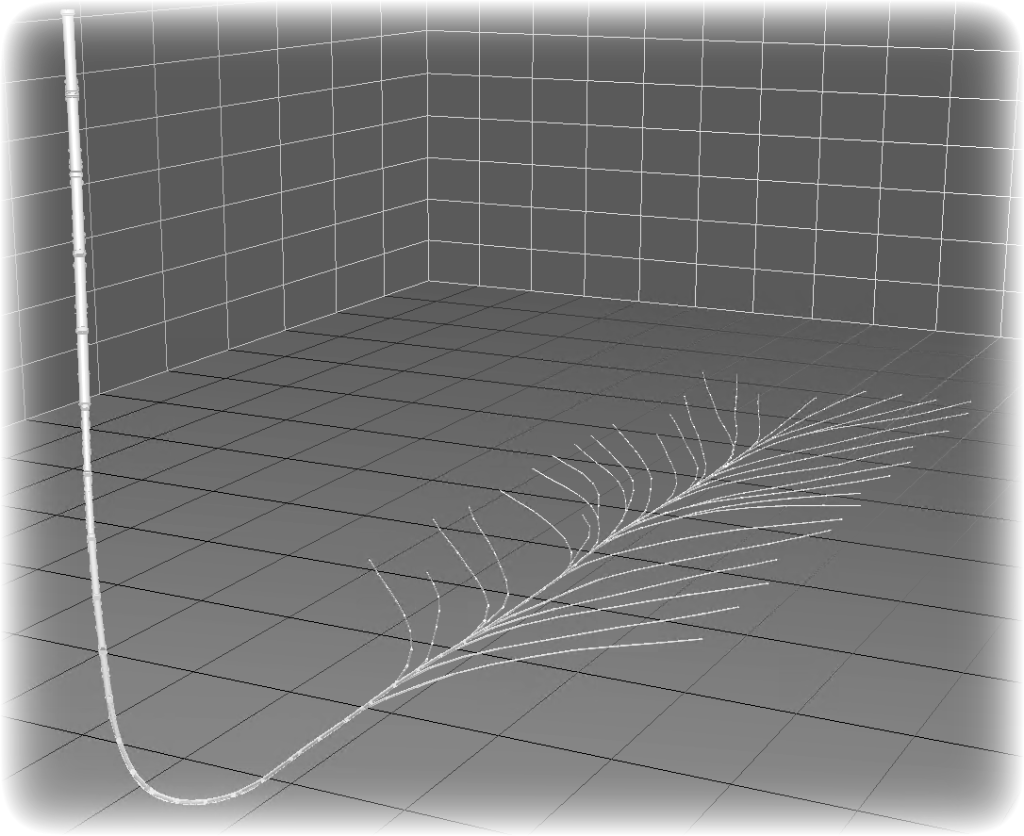

Advances in technologies used for well drilling and completion have enabled the energy industry to reach new sources of oil and natural gas to meet rising demand around the world. New technologies have also helped reduce the environmental impact of energy production by allowing more oil and gas to be produced with fewer wells. Advances in technologies will play a critical role in meeting global energy demand because they enable the discovery of new resources, access to harsh or remote locations and the development of challenged reservoirs that previously were not economic to produce. Well completion is the final step of the drilling process, where the connection to hydrocarbon-bearing rock is established. Again, advances in technology have enabled more oil and natural gas to be recovered from the length of each well, improving production and reducing the environmental footprint of energy production. For example, by combining extended reach drilling capability with advanced stimulation technology, oil companies can optimize how and where stimulation fluid interacts with rock, allowing sustained production rates along the length of the wellbore. Companies are pushing completions in excess of 3,000 meters (9,842 feet) in length, compared to a typical completion of 30 meters a couple of decades ago. These types of drilling and completion technologies have also enabled the recent growth in production from shale and other unconventional oil and gas reservoirs in many parts of the world, using a combination of hydraulic fracturing and horizontal, extended reach drilling. Some examples of advancements in drilling technology are presented below: Horizontal Drilling Horizontal drilling is a directional drilling process aimed to target oil or gas reservoir intersecting it at the “entry point” with a near-horizontal inclination, and remaining within the reservoir until the desired bottom hole location is reached. While the construction of a directional well often costs much more than a conventional well, initial production is greater of a conventional well. Horizontal drilling provides more contact to a reservoir formation than a vertical well and allows more hydrocarbons to be produced from a given wellbore. For example, six to eight horizontal wells drilled from one location, or well pad, can access the same reservoir volume as 16 vertical wells. Using multi-well pads can significantly reduce the overall number of well pads, access roads, pipeline routes and production facilities, minimizing habitat disturbance, impacts to the public and the overall environmental footprint. Horizontal wells are usually drilled to enhance oil production and in some situations the improvement may be dramatic – enabling development of a reservoir which would otherwise have been considered uneconomic. There are many kinds of reservoir where the potential benefits of horizontal drilling are evident: in conventional reservoirs Thin reservoirs; Reservoirs with natural vertical fractures; Reservoirs where water (and gas) coning will develop; thin layered reservoirs; heterogeneous reservoirs; in unconventional reservoirs shale gas/oil, tight gas/oil, CBM, heavy oil, oil sands, etc The initial vertical portion of a horizontal well is typically drilled using the same rotary drilling technique that is used to drill most vertical wells, wherein the entire drill string is rotated at the surface (the drilling of vertical sections is also possible by the use of downhole motor just above the bit, like the VertiTrak or TruTrak, where only the bit rotate while the drilling string remains firm). From the kickoff point to the entry point the curved section of a horizontal well is drilled using a hydraulic motor mounted directly above the bit and powered by the drilling fluid. Steering of the hole is accomplished through the employment of a slightly bent or “steerable” downhole motor (today the technology of directional drilling has improved by the use of the “RSS: Rotary Steerable System” that permit to steer an hole continuing the rotation of the drilling string. The RSS increase the safety and the drilling efficiency). Downhole instrument packages that transmit various sensor readings to operators at the surface are included in the drill string near the bit. Sensors provide the azimuth (direction versus north) and inclination (angle relative to vertical) of the drilling assembly and the position (x, y, and z coordinates) of the drill bit at all times. Additional downhole sensors can be, and often are, included in the drill string, providing information on the downhole environment (bottom hole temperature and pressure, weight on the bit, bit rotation speed, and rotational torque). They may also provide any of several measures of physical characteristics of the surrounding rock such as natural radioactivity and electrical resistance, similar to those obtained by conventional wire line well logging methods, but in this case obtained in real time while drilling ahead. The information is transmitted to the surface via small fluctuations in the pressure of the drilling fluid inside the drill pipe.

June 9 (Reuters) - With AI rapidly becoming a buzzword across industries, oil and gas companies are exploring ways to use this technology to fuel innovation in the energy sector. Here are 10 predictions for future applications of AI in energy, according to brokerage Jefferies. ASSET MANAGEMENT & MONITORING Jefferies expects energy firms to partner with tech companies to develop digital replicas of their infrastructure to manage assets and facilitate predictive maintenance, identifying defects before they occur. Shell has partnered with Akselos, a Swiss modeling and simulation company, to use its digital-twin technology. OPTIMIZE EXPLORATION AI can be utilized to better map recoverable volumes from discovered reservoirs. Shell is using AI-based technology from big-data firm SparkCognition in its deep sea exploration and production to boost oil output, potentially cutting exploration timeline to as little as nine days versus nine months. DRILLING, WELL DESIGN AI platforms could provide optimal designs - including placement and spacing - to maximize productivity. In 2022, oil-field services firm Patterson-UTI (PTEN.O) CEO William A. Hendricks Jr said AI may allow one person to manage 4 rigs instead of one person per rig. MAXIMIZING WELL PRODUCTION AI will be utilized to monitor and adjust well output, flow rate and pressure in real-time and identify anomalies. Range Resources (RRC.N) is testing such an AI algorithm. MAXIMIZING RECOVERY RATES AI could help enhance oil recovery at brownfield sites, subject to declining production and higher operating costs. Italian oilfield services firm Saipem (SPMI.MI) is developing an AI tool to maximize well quality. REFINERY OPTIMIZATION AI will allow refineries to rapidly react to changing market conditions and adjust feedstock and output accordingly. EMISSIONS DETECTION & MONITORING AI-based imaging technology could identify methane plumes and quantify emissions volumes. Chevron (CVX.N) has utilized machine learning and advanced technologies to detect, prevent emissions and make timely repairs. CYBERSECURITY AI could identify and resolve security breaches real time and pinpoint vulnerabilities to minimize breaches. WORKPLACE SAFETY & EFFICIENCY AI could identify potential hazards, track worker fatigue and improve efficiency. CORPORATE & STRATEGIC DECISION MAKING It can also help boost capital budgeting, planning and risk management. Compiled by Arshreet Singh Our Standards: The Thomson Reuters Trust Principles.

Emerging oil & gas industry trends are making the industry more efficient, safer, and smarter. To this end, companies explore ways to efficiently and competitively digitize, automate, and solve complex sub-surface engineering challenges. For example, Artificial intelligence (AI) algorithms provide a competitive edge as well as enable oil & gas companies to increase oilfield or well productivity. Further, the gradual adoption of advanced robotics and data management practices accelerates processing times and reduces the need for human labor. Innovation Map outlines the Top 10 Oil & Gas Industry Trends & 20 Promising Startups For this in-depth research on the Top Oil & Gas Trends and Startups, we analyzed a sample of 2 086 global startups and scaleups. Thanks to data-driven innovation intelligence, this report gives you a strategic overview of emerging technologies & startups in the oil & gas industry. These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform , covering 2 500 000+ startups and scaleups globally. The platform delivers an exhaustive overview of emerging technologies within a specific field and identifies relevant startups and scaleups that matter. In the Innovation Map below, you get an overview of the Top 10 Oil & Gas Trends and Innovations that impact companies worldwide. Moreover, the Oil & Gas Innovation Map reveals 20 hand-picked startups working on emerging technologies. To explore custom insights, get in touch . Top 10 Oil & Gas Industry Trends Internet of Things Artificial Intelligence Big Data & Analytics Robotics & Automation 3D Modeling & Visualization Cloud Computing Augmented & Virtual Reality Manufacturing Execution Systems Predictive Maintenance Blockchain

Jun 11, 2023 (The Expresswire) -- A detailed research report on the Directional Drilling Market has been published by Absolutereports.com, offering an extensive analysis of the market landscape. The report covers various aspects such as current trends, growth rate (CAGR), opportunities, market risks, and key factors driving market growth. Additionally, the report provides a primary analysis of the market, including information on the industry's supply chain structure, changing policies, and the classification of product types, applications, major players, and sectors. It also assesses prominent companies in the industry, presenting their profiles, product portfolios, capacities, pricing, expenses, and revenues. Get a sample PDF of the report at - https://www.absolutereports.com/enquiry/request-sample/22377952 The global Directional Drilling market size was valued at USD 10438.17 million in 2022 and is expected to expand at a CAGR of 4.94 percent during the forecast period, reaching USD 13943.93 million by 2028. Directional drilling (or slant drilling) is the practice of drilling non-vertical wells. It can be broken down into four main groups: oilfield directional drilling, utility installation directional drilling (horizontal directional drilling), directional boring, and surface in seam (SIS), which horizontally intersects a vertical well target to extract coal bed methane. One of the key highlights of this report is its use of self-explained tables, pie charts, and graphs in a smart format, making it easy for readers to understand the latest trends, CAGR status, drivers, developing plans, restraints, trending technologies, and opportunities generated by targeting market-associated stakeholders. The research has identified that the growth of the Directional Drilling Market is mainly driven by expanded RandD spending across the globe. TOP Prominent Players of Directional Drilling Industry ● Cathedral Energy Services Ltd. ● Leam Drilling Systems, LLC. ● Ge Oil and Gas ● Jindal Drilling and Industries Limited ● Schlumberger Limited ● Gyrodata Incorporated ● Halliburton Company ● Baker Hughes Incorporated ● National Oilwell Varco, Inc. ● Nabors Industries Ltd. ● Weatherford International PLC. ● Scientific Drilling International Get a Sample PDF of the Report 2023 Most important types of Directional Drilling products covered in this report are: ● Oilfield directional drilling ● Utility installation directional drilling ● Directional boring and surface in seam Most widely used downstream fields of Directional Drilling market covered in this report are: ● Onshore ● Offshore What is New Additions in 2023 Directional Drilling market Report? ● Brief industry overview ● Overall in-depth information on company players ● Customized report and analyst support on request ● Recent developments in Directional Drilling industry and its futuristic growth opportunities Does this report consider the impact of COVID-19 and the Russia-Ukraine war on the Directional Drilling Market? Yes. As for the impact of COVID-19 on the Directional Drilling market, it is clear that the pandemic has accelerated the adoption of digital and remote research technologies. Many businesses have had to pivot to virtual research methods due to social distancing measures, and this has highlighted the importance of having flexible and adaptable research technologies in place. Overall, businesses that are able to effectively navigate the risks and opportunities presented by new research technologies are likely to have a competitive advantage in their respective markets. Inquire or Share Your Questions If Any Before the Purchasing This Report - https://www.absolutereports.com/enquiry/pre-order-enquiry/22377952 Directional Drilling Market Report Contains 2023: - ● The Directional Drilling Market report provides essential data, statistics, and trends to businesses worldwide. ● This market offers valuable insights into the competitive landscape and industry potential, making it an indispensable resource for decision-makers in various industries. ● The market's top-performing countries include the United States, Canada, Mexico, Germany, France, the United Kingdom, Russia, Italy, China, Japan, Korea, India, Southeast Asia, Australia, Brazil, and Saudi Arabia . Moreover, the progress of key regional Directional Drilling Markets, including North America, Europe, Asia-Pacific, South America, and the Middle East and Africa , is also highlighted. ● The Directional Drilling Market's potential is evaluated based on several factors, including type (Oilfield directional drilling, Utility installation directional drilling, Directional boring and surface in seam), application (Onshore, Offshore), capacity, and end-use industry. ● The market's impact is evaluated based on the most important drivers and restraints, current trends, and dynamics in the global market. ● The Directional Drilling industry forecast provides valuable information related to key drivers, restraints, and opportunities, allowing businesses to make informed decisions about their strategies and investments. Short Description Of Directional Drilling Market: The Directional Drilling Marketing is analysed in detail in this report, with a focus on various aspects such as market size, segment size, and competitor landscape. The report provides valuable insights into the latest developments, trends, and challenges faced by the market. Additionally, the report offers strategic recommendations to companies to overcome the impact of the COVID-19 pandemic on their businesses. Technological advancements and innovation are expected to play a key role in enhancing the performance of the product and expanding its application in various industries. The report also provides an analysis of customer preferences, market dynamics, new product launches, and regional conflicts that are expected to impact the market in the coming years. Furthermore, the report sheds light on the growing importance of carbon neutrality and its impact on the Directional Drilling Marketing. Overall, this report provides a comprehensive analysis of the Directional Drilling Market and equips stakeholders with valuable insights to make informed decisions. Customization of the Report: At our organization, we understand the importance of providing tailored solutions to meet the specific needs of our clients. Whether you require information on a particular industry, geographic location or statistical data, our team of research analysts can customize the report to meet your exact requirements. We are committed to ensuring that our clients receive accurate and reliable information that is relevant to their business needs. To Understand How Covid-19 Impact Is Covered in This Report - https://absolutereports.com/enquiry/request-covid19/22377952 Following chapters are covered in this report: Chapter 1 is the basis of the entire report. In this chapter, we define the market concept and market scope of Rituximab, including product classification, application areas, and the entire report covered area. Chapter 2 is the core idea of the whole report. In this chapter, we provide a detailed introduction to our research methods and data sources. Chapter 3 focuses on analyzing the current competitive situation in the Rituximab market and provides basic information, market data, product introductions, etc. of leading companies in the industry. At the same time, Chapter 3 includes the highlighted analysis--Strategies for Company to Deal with the Impact of COVID-19. Chapter 4 provides breakdown data of different types of products, as well as market forecasts. Different application fields have different usage and development prospects of products. Therefore, Chapter 5 provides subdivision data of different application fields and market forecasts. Chapter 6 includes detailed data of major regions of the world, including detailed data of major regions of the world. North America, Asia Pacific, Europe, South America, Middle East and Africa. Chapters 7-26 focus on the regional market. We have selected the most representative 20 countries from 197 countries in the world and conducted a detailed analysis and overview of the market development of these countries. Chapter 27 focuses on market qualitative analysis, providing market driving factor analysis, market development constraints, PEST analysis, industry trends under COVID-19, market entry strategy analysis, etc.

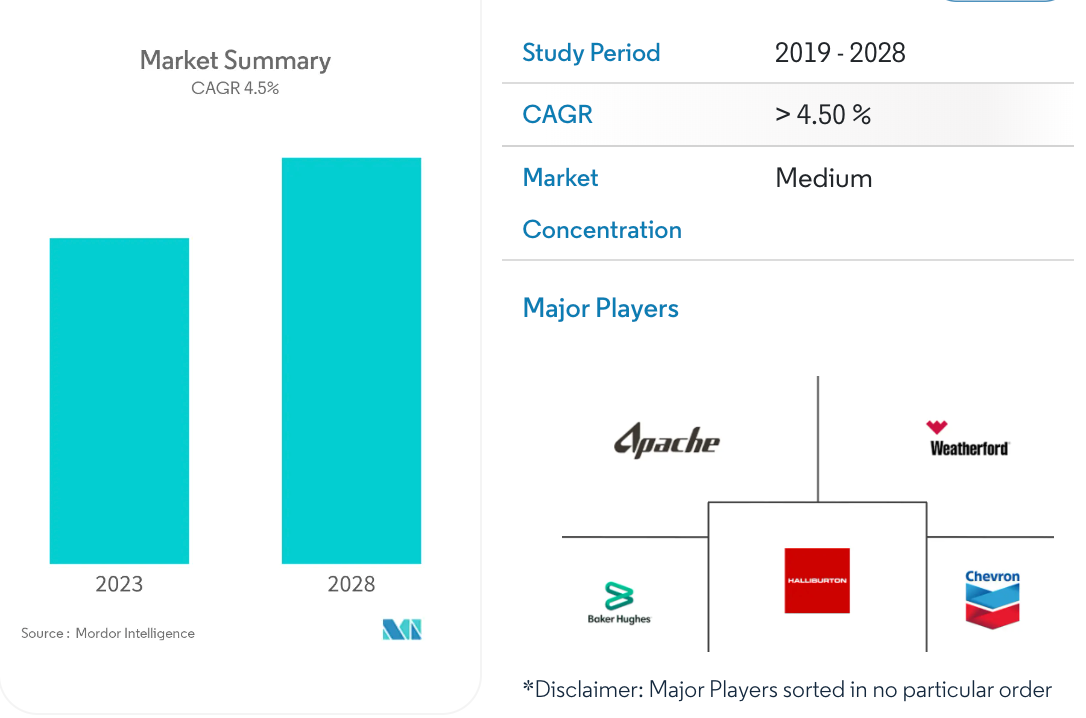

North America Directional Drilling Market Analysis The North America Directional drilling market is projected to register a CAGR of over 4.5% during the forecast period (2022-2027). The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels. Over the long term, drilling in unconventional reserves, which involves directional or horizontal type drilling to increase contact with the pay zone along with increased production, is expected to drive the growth of the market studied. On the other hand, high volatility of crude oil prices and low-price scenarios is expected to restrain the growth of the Directional drilling maWith technological Nevertheless, with technological improvements and increasing viability of deepwater and ultra-deepwater projects, several new markets, such as the Gulf of Mexico actively promoting the development of deepwater and ultra-deepwater reserves are likely to provide an excellent opportunity in the forecast period. United States dominates the market and is also likely to witness the highest CAGR during the forecast period. In recent years the United States has emerged as a major crude oil and natural gas producer in the world, and the country is expected to maintain this during the forecast period. North America Directional Drilling Industry Segmentation Directional drilling is a technique used by oil-extraction companies in order to access oil in underground reserves. Directional drilling is also called directional boring. Most oil wells are positioned above the targeted reservoir, so accessing them involves drilling vertically from the surface through to the well below. The directional drilling market is segmented by service type, location of deployment, and geography. By service type, the market is segmented into rotary steerable systems, and conventional. By location of deployment, the market is segmented into onshore, and offshore. The report also covers the market size and forecasts for the Directional drilling market across major countries. For each segment, the market sizing and forecasts have been done based on revenue (USD billion).