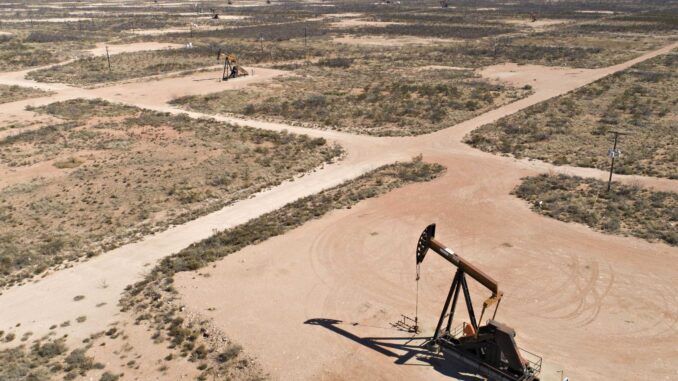

A gas flare burns past a pump jack in Loving County in this December 2018 file photo. Emissions management is one of the top four trends EY sees in the oil and gas space in 2024.

Angus Mordant/Bloomberg

ExxonMobil, Chevron and Occidental each made multi-billion-dollar acquisitions as 2023 came to an end while ConocoPhillips made two major acquisitions in the last two years.

That, according to Reuters, positions the four companies to control 58% of Permian Basin production. Mergers and acquisitions topped EY’s list of four oil and gas trends to expect in the new year.

Transformative Deals – While high interest rates and inflationary pressures cooled deal-making in many sectors in 2023, the oil and gas sector has seen a surge in announced M&A activity, driven by strong cash flows, renewed investor confidence and increasing recognition that oil and gas will continue to play an important role in the energy landscape. A wave of consolidations and strategic investments in low-carbon solutions – such as carbon capture, hydrogen, renewable natural gas and others – will continue in the year ahead, as creative dealmaking, partnerships and ecosystems emerge.

Emissions Management – With stringent new climate disclosure rules set to take effect in the EU, California and potentially the U.S., 2024 looms as a crucial staging year for both the industry and its extensive supply chain. This regulatory uptick has led companies to accelerate efforts to reliably monitor and report emissions, however shifting the thinking from compliance to innovation in future commercial opportunities will be front and center. For example, how the industry considers product differentiation and less carbon intensive products.

Decarbonization Technologies – The oil and gas industry has responded to federal incentives for emerging energy technology, particularly in hydrogen and carbon capture. Oil and gas companies bring a unique level of financial wherewithal, technical skill and foresight in driving these new solutions forward. However, while legislation like the Inflation Reduction Act and Infrastructure Investment and Jobs Act provide incentives and funds for developing these technologies, its largely depended on participants to create demand. The real winners of the IRA and IIJA will be those companies that can best innovate new commercial approaches to these novel business areas.

Maximize Operations - Maximizing operations throughout the enterprise by using disruptive technology at speed and scale, all while upskilling the workforce will be important as companies transform. By focusing on operational efficiencies, the oil and gas industry can continue to solve complex issues while integrating new acquisitions, implementing emerging technologies like AI and utilizing real-time data and connected strategy to enable better, faster and more strategic decisions with the impact on its workforce.