But oil prices are still considerably below last summer’s highs, dragging down producer revenues. That is going to mean hard choices for businesses such as international major oil companies and independent drillers, as well as for energy investors and policy makers who have benefited from the past year’s largess.

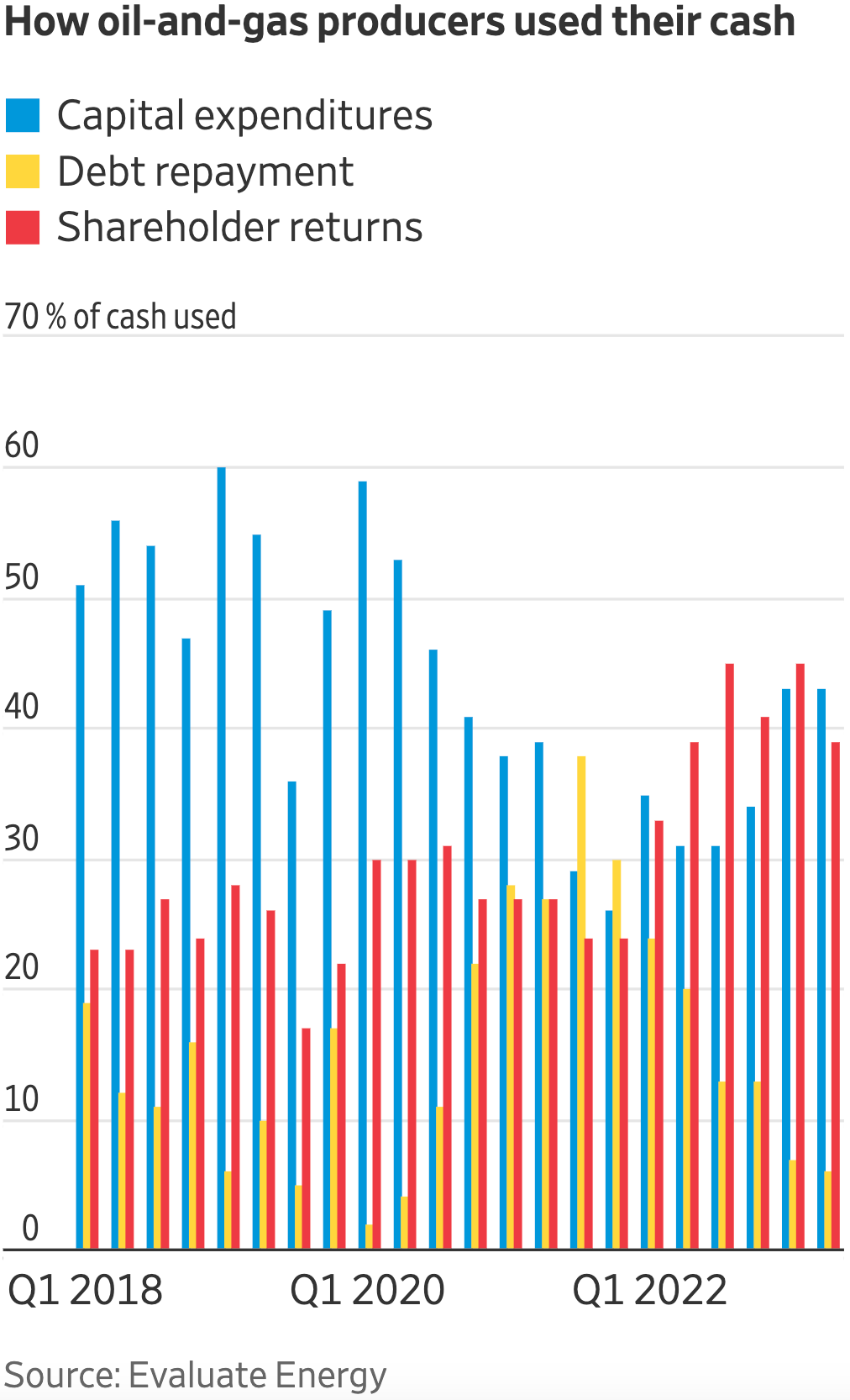

“It is moving toward companies spending what they can while they can,” said Mark Young, a senior analyst at data-analytics firm Evaluate Energy.

How the industry uses its cash in coming years has huge implications for U.S. drivers and energy investors. Oil executives last year buoyed their stock prices by funneling most of their wartime windfalls to investors—not new drilling. As a surge in fuel costs supercharged inflation to 40-year highs, President Biden accused oil firms of profiteering and urged them to invest in boosting capacity.

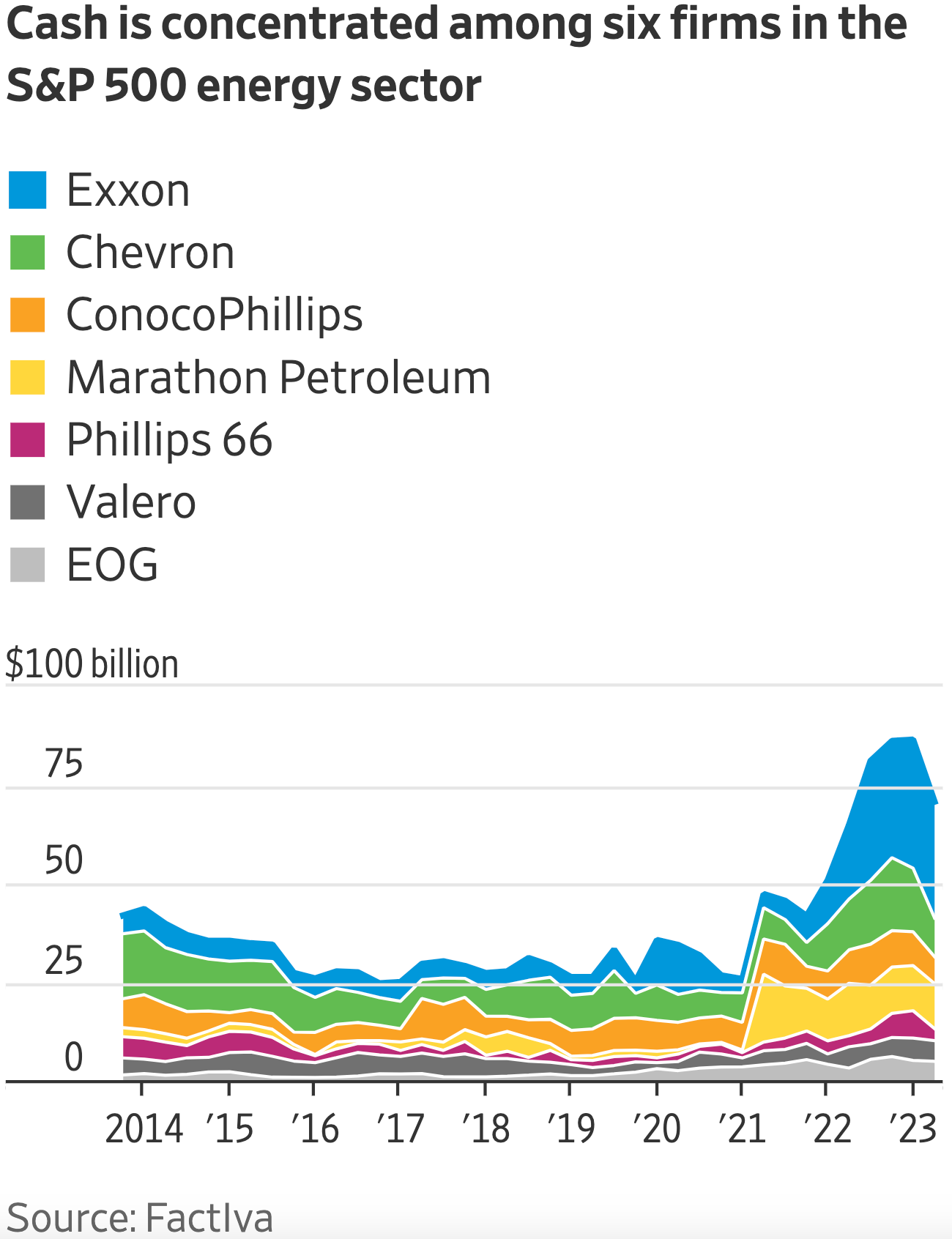

Higher oil prices gradually encouraged the industry to do just that. Exxon Mobil and Chevron increased capital spending last quarter from a year ago while paying a combined $15.2 billion in dividends and buybacks.