In the 2023 Winter Fuels Outlook (WFO) supplement to our October Short-Term Energy Outlook (STEO), we forecast that U.S. households that heat primarily with heating oil will spend more this winter on heating, but households heating primarily with propane will spend less. Higher heating oil expenditures are driven by more consumption than last winter, and lower propane expenditures are driven by lower prices. However, there are significant regional variations in forecast propane expenditures, with expenditures in the Midwest lower than last winter, expenditures in the Northeast essentially flat, and expenditures in the South higher.

We base our weather assumptions in the WFO, which also examines trends for households heating with natural gas and electricity, on data from the National Oceanic and Atmospheric Administration (NOAA) and the previous 30-year trend. We use heating degree days (HDDs) as a measure of how cold temperatures are compared with a base temperature—more HDDs indicate colder temperatures. Our warmer case has 10% fewer HDDs than our base assumption, and our colder case has 10% more. Beginning with this year’s WFO, we consider winter to run from November through March. In previous years, winter also included October. We recalculated the previous winters referenced in this report to exclude October data.

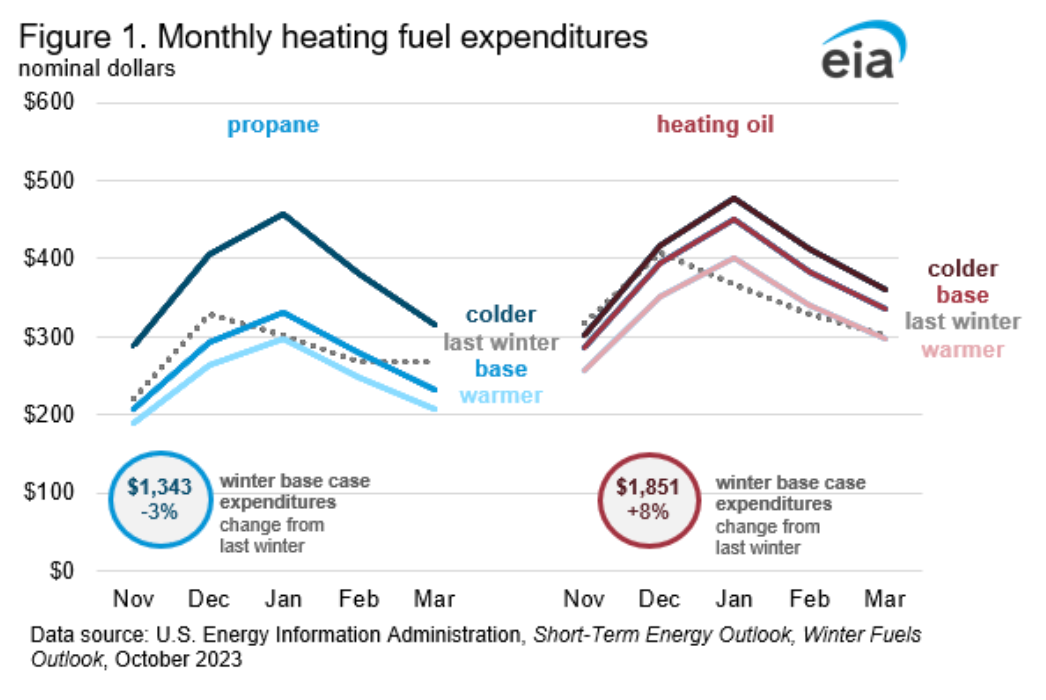

In our base case, we forecast that the 4% of U.S. households that heat primarily with heating oil will spend an average of $1,851 this winter, up 8% from last winter, and the 5% of U.S. households heating primarily with propane will spend $1,343, down 3% from last winter. In our 10% warmer-weather case, we forecast heating oil costs will average $1,648, and in our 10% colder-weather case, we forecast costs will average $1,969 (Figure 1). In our 10% warmer-weather case, we forecast propane costs will average $1,205, and in our 10% colder-weather case, we forecast costs will average $1,847.

In our base case, we forecast that households that heat primarily with heating oil will consume 440 gallons of fuel this winter, up from 400 gallons last winter. Although we forecast a somewhat colder winter this year than last year, we expect this winter to be slightly warmer than average, with fewer HDDs than the average of the past five winters (winter 2017–18 through winter 2021–22).

We forecast the heating oil price will average $4.20 per gallon (gal) this winter, down from $4.31/gal last winter. This decrease is driven by lower crack spreads (the difference between the price of crude oil and the spot price of heating oil).

Although we expect crack spreads to be lower this winter than the historic highs last winter (winter 2022–23), the forecast crack spread this winter is relatively high, more than double the average of the five winters between 2017–18 and 2021–22.

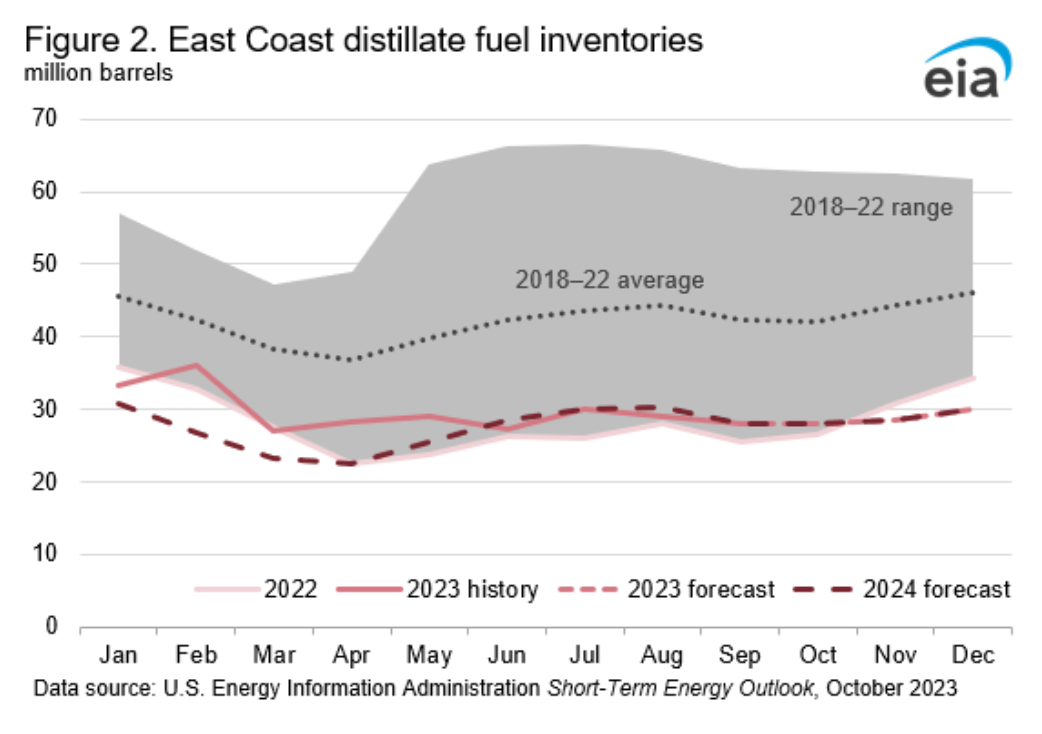

Almost all heating oil consumption in the United States occurs in the Northeast (PADDs 1A and 1B), which has relatively little refining capacity and relies on transfers from other regions and on imports for much of its heating oil supply. Distillate inventories in the East Coast (which include heating oil) are near the bottom of the five-year (2018-22) range. Refinery turnarounds at the Monroe Energy refinery in Trainer, Pennsylvania, and the Irving Oil refinery in Saint John, New Brunswick, Canada are likely to put further pressure on regional distillate inventories. We forecast that East Coast distillate inventories will fall below the November 2022 level and remain near the bottom of the previous five-year range through the forecast period (Figure 2). Additional uncertainty around shifting trade flows as a result of Russia’s full-scale invasion of Ukraine (and related sanctions) plus Russia’s recent ban on diesel exports and the subsequent partial lifting of that ban increases uncertainty about distillate imports and forecast prices.

We expect households that heat with propane in the Northeast will spend about the same as last winter, households in the Midwest will spend 11% less, and households in the South will spend 6% more. In the 10% colder-weather case, we forecast that household spending for propane will be more than 30% higher than last winter.

Propane spot prices typically follow crude oil and natural gas prices but can vary significantly, depending on supply and demand conditions, particularly in response to winter weather. The propane spot price at the U.S. benchmark at Mont Belvieu, Texas, was 73 cents/gal in September, which is 8% lower than the price in March (the end of the 2022–23 winter heating season). We forecast the Mt. Belvieu spot price will average almost 76 cents/gal throughout the winter, 5% lower than last winter.

U.S. propane inventories on October 6, 2023, were 101.4 million barrels, about 15.1 million barrels above the five-year average and at the top of the five-year range (Figure 3). We expect U.S. propane inventories to remain well above the five-year average heading into the winter heating season this year.

We expect U.S. propane consumption across all sectors to be up about 8% this winter compared with last winter. Last winter, propane consumption in the United States was the least in more than a decade. Propane is also used in commercial grain dryers, and the U.S. Department of Agriculture estimates that this year’s corn crop will reach maturity and be harvested earlier than the five-year average due to a relatively warm and dry autumn and poor corn crop condition. When the corn crop reaches maturity early, producers can postpone harvest to allow the crop to dry in the field, reducing demand for propane for commercial grain drying.